This information is designed to introduce you to the home purchase process and the roles of the people you will meet during your experience with us. You’ll see the ways our experienced professionals will help you make the informed and practical decisions needed to meet or exceed your home buying goals

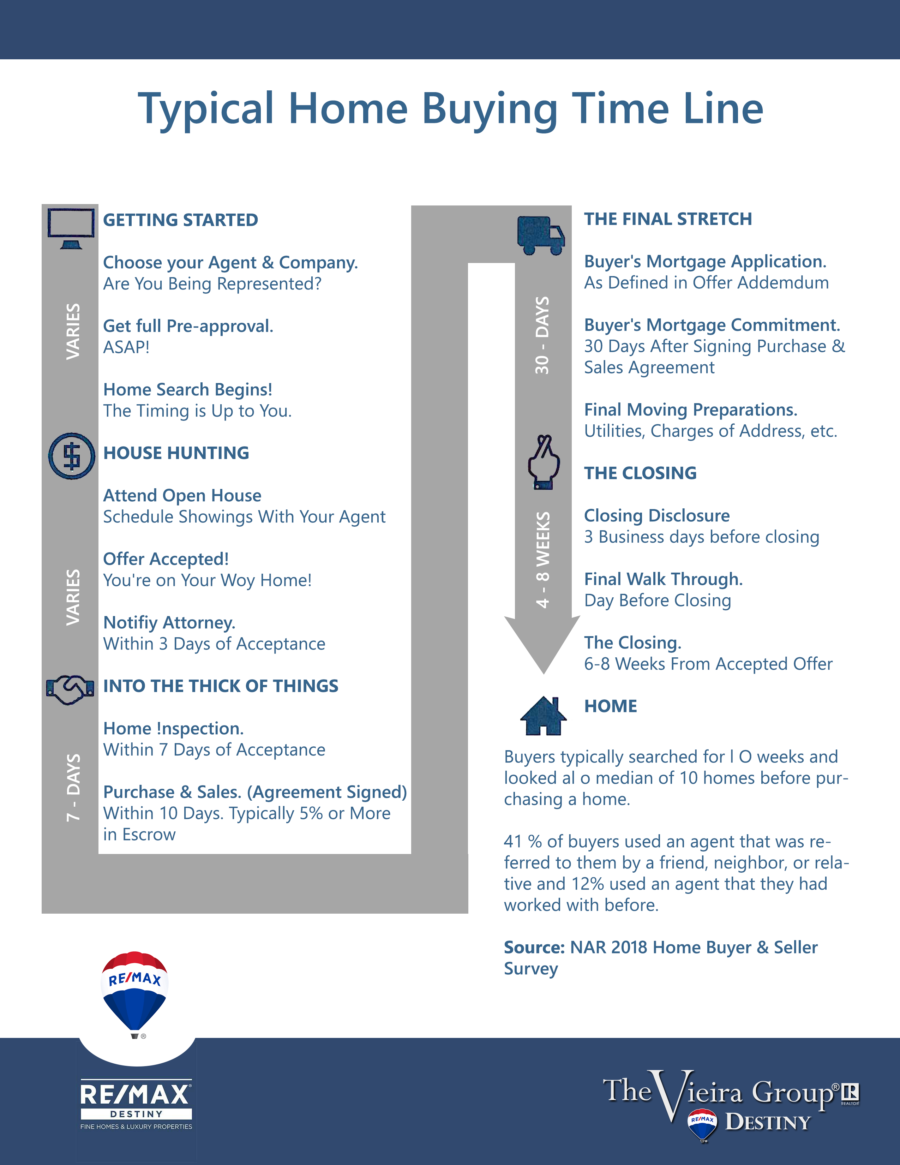

We have divided the process into three key components: Getting Started, Into the Thick of Things, and The Home Stretch. We hope this overview will give you a sense of what are the steps that will make up your home buying experience. See below for more details.

A. Getting Started

Choosing your agent and real estate company: Many buyers start out by attending a few open houses before making contact with a Realtor*. An open house is not only a chance for a realtor to show a property to the public; it is also an excellent way for the agent to meet potential buyers and sellers. However, you should never feel pressured to accept just anyone.

When selecting an agent, be sure that the agent listens to you and asks questions clearly directed toward fully understanding your needs and concerns. Your agent should impress you as a dedicated and skilled professional. As a solid partner in the process of finding your new home, your agent should be happy to answer your questions about agency relationships and buyer representation.

Not all agents or brokers are Realtors. Realtors are members of their local, State and National Associations of Realtors. They are committed professionals that agree to conduct their practice under the National Association of Realtors code of ethics.

Real estate sales agents and brokers are independent contractors, not employees.

Be sure that your agent explains the standard forms and gives you an AGENCY DISCLOSURE form to sign. This is an acknowledgment that describes who works for whom. It’s required by State Law.

Importance of having a loan pre-approval: It is important to be prepared and well educated before you get too deep in the marketplace. All too often an unprepared buyer finds the home of his or her dreams only to lose it due to competition or misinformation. Securing pre-approval for a mortgage is a simple process where you give permission for a credit check and the lender gives you a letter that states your ability to afford a particular property. All pre-approvals are subject to an independent appraisal. This process will help you determine what you can afford or want to pay for your new home.

Shopping For Your Home: Once you connect with the right Realtor and have your pre-approval in hand, it’s time to get serious about finding your new home. This process can take some time depending on how comfortable you are with the market. Some buyers find the right home very quickly where others need more time to learn market values. Regardless of your price range, buying real estate always requires compromise. Some buyers put a premium on square footage while others may insist on being within an easy walk of the T. Couples should work on a priority list together. Our job is to assist you in defining the alternatives and outlining the options along the way.

Tips for starting the search:

- It is not uncommon to start a home search with two or three top choice towns in mind. It usually does not take long to zero in on the preferred location.

- Establish a list of the items most important to you and your significant other and share it with your Realtor.

- Go online to boston.com and other websites. Sign up for automatic email listing updates in your price range to stay up to date.

- Select some homes you might be interested in touring, and explore those neighborhoods by car or on foot. Be sure to visit at night as well.

- Take notes about the properties in which you see the potential.

- Remember you are not just buying a new home; you are buying a new lifestyle.

B. Into the Thick of Things

Comparing Value: Compare similar properties sold within the last six months to a year to what is available in the current active market. Ask yourself;

- How much do you love the house?

- How will you feel if you do NOT get this house?

- Are you willing to pay more than everyone else to get this house?

Making An Offer: When you find the house you want, the purchase process begins with a written offer to purchase

- All written offers must be presented to the Seller.

- A word of caution: Verbal offers are not valid in Massachusetts.

- Time is of the essence. Once a deadline passes the offer is technically no longer valid.

- When the Buyer and Seller sign the offer and a deposit check is attached, there is a bona fide contract in place.

Selecting an Attorney & Home Inspector: Realtors know the market and the process, not the law. You need an attorney when buying a home:

- For legal advice and to assist with any problem areas that may arise during the process.

- To draft and /or revise the Purchase and Sale Agreement to protect your interests.

- To prepare you for the financial accounting portion of the purchase and answer such questions as “How much money do I need to bring to the closing?”

Tips about working with your attorney: Be sure to discuss fees in the first meeting so that your bill is not a surprise!

- Some attorneys charge a flat fee when they are representing both you and the lender, but you may prefer an attorney who bills hourly for services rendered.

The Home Inspection & Due Diligence

You should hire an expert to conduct a home inspection AFTER the offer has been signed, but BEFORE you sign the Purchase and Sale Agreement. This period of time is called the “Due Diligence Period” where you fulfill promises and conditions made in your offer to purchase.

How to find a home inspector: Ask friends who they have used for their inspections.

- Get referrals from your lawyer or agent (only a Buyer’s agent can refer Inspectors).

Signing The Purchase & Sales Agreement: A Purchase and Sales Agreement is a detailed contract for the purchase of a property. Typically there is a negotiation process between the Seller’s attorney and the Buyer’s attorney to draft a document acceptable to both parties. It often contains a four-page standard document with various riders added by the attorneys.

What is typically adjusted or added to the original offer terms?

- Establishing who will hold the deposit

- A list of any repairs to be completed by the seller

- Specifications & plans if new construction is being planned

- The inclusion of any modified terms since the accepted offer to purchase real estate

The Signing Process: Typically the completed P&S is sent to the buyer’s Realtor for signing. Typically four copies are made so that each side will have two fully executed original copies. The buyers will also write a check for the additional deposit amount matching the total to be held in escrow as outlined in the document. After the buyer(s) sign the four copies of the P&S they are delivered to the seller’s agent who will typically deposit the funds and have all four copies signed by the seller(s). Two copies are returned to the buyer’s agent for distribution.

Submitting Full Loan Application & Loan Processing: Once the P&S has been signed it is time to submit your loan application. You have probably already decided on a type of loan program and even notified the loan officer that you have a home under an agreement. Your pre-approval says that the lender has approved you for a loan; however, the pre-approval is subject to an independent appraisal of the property.

C. The Home Stretch

Mortgage Commitment: Mortgage commitment is the final hurdle to buying your home. The mortgage commitment date is the only contingency from the original offer that is continued into the P&S agreement. This date marks a point of no return for the funds you have in escrow toward the purchase of the property. Therefore it is imperative that you obtain a full mortgage commitment by that date. Otherwise, you must either have an extension of performance signed to extend the date or withdraw from the transaction and work to get your deposit back. The mortgage commitment date is your last chance to withdraw provided that financing as outlined in the offer is not obtained.

Moving Preparations: You will need to set up service to your new home including; cable, phone, gas and or electric, change of address, etc. Your agent is a good resource for contact information.

Final Walk Through: This is your last chance to check the condition of the property before the purchase. The final inspection is usually arranged through the agents. If the condition of the property is significantly different or if promises have not been kept, you should speak with your lawyer to plan your next course of action.

If you do not do a final walk through and a problem with the house is discovered AFTER the closing, you will have no legal recourse. You will be stuck with the problem.

The Closing: This is a meeting to complete the transfer of the property from the Seller to the Buyer.

All parties meet either at the Registry of Deeds for the county in which the property is located, or at the office of the Buyer’s bank’s attorney, or at the real estate office.

Attending the closing will be: Buyers or buyer’s power of attorney, Sellers or Seller’s power of attorney, The bank’s attorney, who prepared the closing documents, The Buyer’s attorney (if you choose to have him/her there), The Seller’s attorney (if the seller chooses to have him/her there), Realtors may or may not attend depending on circumstances and scheduling.

During the meeting, the Seller will present the deed of transfer to the Buyer and execute several documents affirming that the closing is taking place as planned by all parties. The Buyer will sign many pieces of paper, including the two most important documents:

THE PROMISSORY NOTE, which obligates the Buyer to pay back to the bank the loan amount over a term of years with a stated amount of interest; and THE MORTGAGE, which attaches the Buyer’s promise to repay the debt onto the house, so that if the bank does not receive its money the bank may foreclose on the property. This means that if the Buyer does not pay the mortgage debt each month the bank may take and sell the house to repay the Buyer’s unpaid debt.

Then You Are Handed The Keys And Your Off To Your New Home!