This approach is a full service and high-performing process to make sure that every aspect of the marketing plan is well thought out and has proven results in making your home sale successful. We have studied the best practices for staging a home to sell and can walk you through the small improvements you can do to maximize your home’s sale price and reduce the time it sits on the market, whether it be removing personal items, changing the furniture layout, or painting the front door.

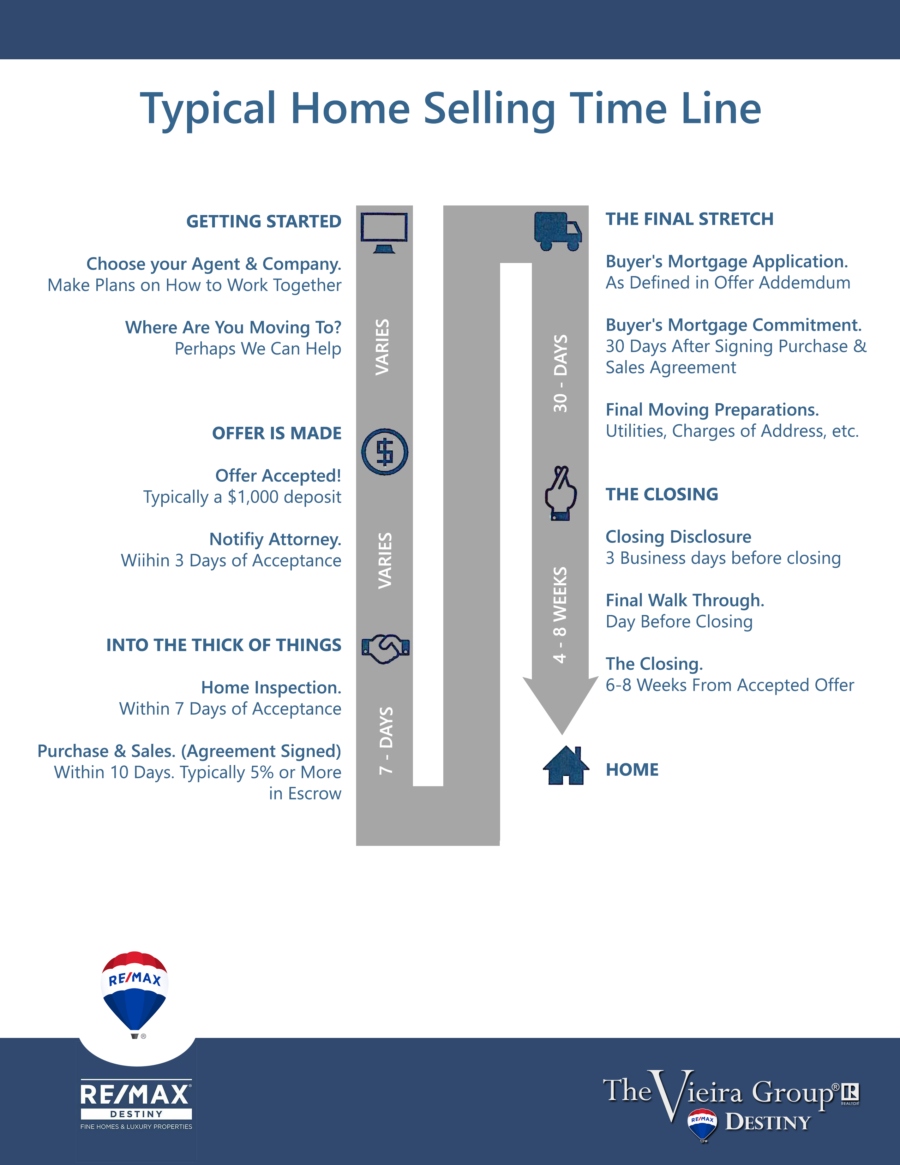

We have divided the process into three key components: Getting Started, Into the Thick of Things, and The Home Stretch. We hope this overview will give you a sense of what are the steps that will make up your home selling experience. See below for more details.

A. Getting Started

Choosing your agent and real estate company: Many sellers start out by attending a few open houses before making contact with a Realtor*. An open house is not only a chance for a realtor to show a property to the public; it is also an excellent way for the agent to meet potential buyers and sellers. However, you should never feel pressured to accept just anyone.

When selecting an agent, be sure that the agent listens to you and asks questions clearly directed toward fully understanding your needs and concerns. Your agent should impress you as a dedicated and skilled professional. As a solid partner in the process of finding your new home, your agent should be happy to answer your questions about agency relationships and seller representation.

Not all agents or brokers are Realtors. Realtors are members of their local, State and National Associations of Realtors. They are committed professionals that agree to conduct their practice under the National Association of Realtors code of ethics.

Real estate sales agents and brokers are independent contractors, not employees.

Be sure that your agent explains the standard forms and gives you an AGENCY DISCLOSURE form to sign. This is an acknowledgment that describes who works for whom. It’s required by State Law.

Is the home ready to sell? The decisions you make in selling your home could save you or cost you, that’s why you need an agent to help you along the way. Be ready and make plans with your agent to best work together in getting your home ready to sell. This is the time that your agent places the home on the market for sale.

Step by step guide to consider:

- Should you sell at all? If you are considering selling because you need more space, have you instead considered building an extension, converting the attic, or digging out the basement? Have you thought about how changing house prices might affect the decision to sell? Perhaps you are thinking about downsizing? Are you in negative equity? If so, can you afford to sell? You may be considering selling as a result of a separation or divorce, depending upon your circumstances, you might need to answer these questions.

- Figure out your finances. You should notify your mortgage lender that you are planning to sell your home. You need to get a rough idea of how much your house is worth, then you can calculate how much money you will be left with after you have paid off the mortgage. If you are also buying a new home, you should obviously consider what size mortgage you will need for that. At the early stages, the figures will be approximate only – you don’t know how much you will sell your house for and you will only get a precise redemption (amount outstanding) figure for your mortgage once you have an agreed completion date when you have exchange contracts.

- Prepare your home. If you “stage” your home well, you are not only more likely to sell your home faster, but you might make it more valuable too. Hire a professional advisor from your real estate agent regarding the value of your home.

- Decide which firm you want to use before you agree to the sale of your house – but you can obviously only instruct them after you have agreed on an offer.

B. Into the Thick of Things

Comparing Value: Compare similar properties sold within the last six months to a year to what is available in the current active market. Ask yourself;

- How much do you love the house?

- How will you feel if you do NOT get this house?

- Are you willing to pay more than everyone else to get this house?

Making An Offer: When you find the house you want, the purchase process begins with a written offer to purchase

- All written offers must be presented to the Seller.

- A word of caution: Verbal offers are not valid in Massachusetts.

- Time is of the essence. Once a deadline passes the offer is technically no longer valid.

- When the Buyer and Seller sign the offer and a deposit check is attached, there is a bona fide contract in place.

Selecting an Attorney: Realtors know the market and the process, not the law. You need an attorney when buying a home:

- For legal advice and to assist with any problem areas that may arise during the process.

- To draft and /or revise the Purchase and Sale Agreement to protect your interests.

- To prepare you for the financial accounting portion of the purchase and answer such questions as “How much money I may or not get at the closing?”

Tips for working with your attorney: Be sure to discuss fees in the first meeting so that your bill is not a surprise!

- Some attorneys charge a flat fee when they are representing you, but you may prefer an attorney who bills hourly for services rendered.

The Home Inspection is done by the Buyer:

- The Buyer will hire an expert to conduct a home inspection AFTER the offer has been signed, but BEFORE they sign the Purchase and Sale Agreement. This period of time is called the “Due Diligence Period” where they fulfill promises and conditions made in your offer to purchase.

Signing The Purchase & Sales Agreement: A Purchase and Sales Agreement is a detailed contract for the purchase of the property. Typically there is a negotiation process between the Seller’s attorney and the Buyer’s attorney to draft a document acceptable to both parties. It often contains a four-page standard document with various riders added by the attorneys.

What is typically adjusted or added to the original offer terms?

- Establishing who will hold the deposit

- A list of any repairs to be completed by the seller

- Specifications & plans if new construction is being planned

- Inclusion of any modified terms since the accepted offer to purchase real estate

The Signing Process: Typically the completed P&S is sent to the buyer’s Realtor for signing. Typically four copies are made so that each side will have two fully executed original copies. The buyers will also write a check for the additional deposit amount matching the total to be held in escrow as outlined in the document. After the buyer(s) sign the four copies of the P&S they are delivered to the seller’s agent who will typically deposit the funds and have all four copies signed by the seller(s). Two copies are returned to the buyer’s agent for distribution.

Submitting Full Loan Application & Loan Processing which is done by the Buyer: Once the P&S has been signed it is time to submit loan application by the buyer. They have probably already decided on a type of loan program and even notified the loan officer that you have a home under the agreement. Their pre-approval says that the lender has approved then for a loan; however, the pre-approval is subject to an independent appraisal of the property.

C. The Home Stretch

Mortgage Commitment: Mortgage commitment is the final hurdle to buying your home. The mortgage commitment date is the only contingency from the original offer that is continued into the P&S agreement. This date marks a point of no return for the funds you have in escrow toward the purchase of the property. Therefore it is imperative that you obtain a full mortgage commitment by that date. Otherwise, they must either have an extension of performance signed to extend the date or withdraw from the transaction and work to get your deposit back. The mortgage commitment date is your last chance to withdraw provided that financing as outlined in the offer is not obtained.

Moving Preparations: You will need to set up service to your new home including; cable, phone, gas and or electric, change of address, etc. Your agent is a good resource for contact information. Plus, you are going to have been moved out of your present home prior to the closing

Final Walk Through: This is their last chance to check the condition of the property before the purchase. The final inspection is usually arranged through the buyer’s agents. If the condition of the property is significantly different or if promises have not been kept, They should speak with your lawyer to plan your next course of action.

If they do not do a final walk through and a problem with the house is discovered AFTER the closing, they will have no legal recourse. They will be stuck with the problem.

The Closing: This is a meeting to complete the transfer of the property from the Seller to the Buyer.

All parties meet either at the Registry of Deeds for the county in which the property is located, or at the office of the Buyer’s bank’s attorney, or at the real estate office.

Attending the closing will be: Buyers or buyer’s power of attorney, Sellers or Seller’s power of attorney, The bank’s attorney, who prepared the closing documents, The Buyer’s attorney (if you choose to have him/her there), The Seller’s attorney (if the seller chooses to have him/her there), Realtors may or may not attend depending on circumstances and scheduling.

During the meeting, the Seller will present the deed of transfer to the Buyer and execute several documents affirming that the closing is taking place as planned by all parties. The Buyer will sign many pieces of paper, including the two most important documents:

THE PROMISSORY NOTE, which obligates the Buyer to pay back to the bank the loan amount over a term of years with a stated amount of interest; and THE MORTGAGE, which attaches the Buyer’s promise to repay the debt onto the house, so that if the bank does not receive its money the bank may foreclose on the property. This means that if the Buyer does not pay the mortgage debt each month the bank may take and sell the house to repay the Buyer’s unpaid debt.